new jersey 529 plan deduction

New Jersey does not offer a deduction for 529 plan contributions. The benefit will only be available to households with an.

College Save Advisor North Dakota 529 College Savings Plan Ratings Tax Benefits Fees And Performance

Section 529 - Qualified Tuition Plans.

. New Jersey taxpayers with gross income of 200000 or less may qualify for a state income tax deduction for contributions into an NJBEST plan of up to 10000 per taxpayer per year beginning with contributions made in tax year 2022. Beginning in tax year 2022 New Jersey will join its peers in allowing a state income tax deduction of up to 10000 per. The New Jersey College Affordability Act allows for a state tax deduction for contributions into a Franklin Templeton 529 College Savings Plan of up to 10000 per taxpayer per year with gross income of 200000 or less beginning with contributions made in tax year 2022.

Also please note that New Jersey taxpayers with gross income of 200000 or less can qualify for a state income tax deduction of up to 10000 per taxpayer for contributions to the plan. Unfortunately New Jersey does not offer any tax benefits for socking away funds in a 529 account for your child. New Jersey No Yes Beginning with the 2022 tax year maximum deduction of 10000 per taxpayer per year for taxpayers with gross incomes of 200000 or less that contribute to New Jerseys 529 plan Contributions made before 2022 tax year are not deductible New Mexico No Yes Contributions to New Mexico 529 plans are fully deductible.

However when you contribute to a 529 plan with yourself as beneficiary this is not a gift and the limits do not apply. A 529 plan is designed to help save for college. This scholarship is only available if the 529 beneficiary attends a.

NJ residents can claim a tax deduction for contributions to a NJ 529 plan. To get started you can deposit 25. Thankfully NJ residents can open an account in any other state that lets them.

The New Jersey College Affordability Act allows taxpayers with household. The investment is tax-free when a family takes a distribution to pay for qualified education expenses. New Jersey does not provide any tax benefits for 529 contributions.

For more information please see NY 529 Plans. In New Mexico families can deduct 100 of their contributions to New Mexicos 529 plan on their state taxes. Now New Jersey taxpayers with gross income of 200000 or less can qualify for a state income tax deduction of up to 10000 per taxpayerfor contributions to the plan.

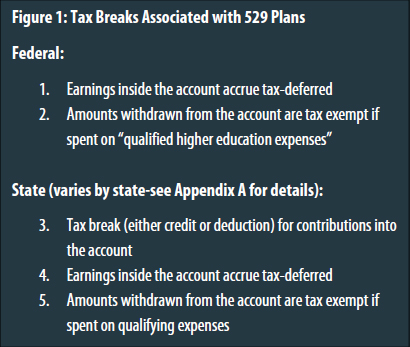

NJBEST 529 College Savings Plan is a traditional NJ 529 plan that allows you to invest money today and reap tax benefits when you withdraw it to pay for qualified education expenses. If you use the money for qualified educational expenses the earnings remain tax-free. Contributions to such plans are not deductible but the money grows tax-free while it remains in the plan.

But if you live in New York and pay New York state income taxes you may be able to deduct the contributions on your New York tax return. Many states provide an income tax deduction for contributing to a college savings plan including New York which provides a maximum annual 10000 deduction. 529 Plan Tax Deduction Beginning with the 2022 Tax Year the law will allow New Jersey taxpayers to deduct 529 plan contributions of up to 10000 per year from state taxable income.

As of January 2019 there are no tax deduction benefits when making a contribution to a 529 plan in New Jersey however you do have the ability to take advantage of up to a 1500 maximum scholarship by investing within the program for over 12 years. New York families can reduce their tax liability by 5000 individual filers or 10000 married joint filers when they. New Jersey has two 529 savings programs both.

Contributions are deductible in computing state taxable income 529 plan contributions grow tax-free. Youll enter the 529 contributions during the New York state tax interview under Changes to Federal Income. New Jersey taxpayers with a gross income of 200000 or less may qualify for a state income tax deduction for contributions into an NJBEST plan of up to 10000 per taxpayer per year beginning with contributions made in tax year 2022.

The plan NJBESTis offered through Franklin Templeton. Direct this New Jersey 529 plan can be purchased directly from the state. And Connecticut with a 10000 maximum.

Thats a deduction of up. The proposal includes a provision to allow New Jersey taxpayers to deduct 529 plan contributions of up to 10000 per year from state taxable income. New Jersey No Yes Beginning with the 2022 tax year maximum deduction of 10000 per taxpayer per year for taxpayers with gross incomes of 200000 or less that contribute to New Jerseys 529 plan Contributions made before 2022 tax year are not deductible New Mexico No Yes Contributions to New Mexico 529 plans are fully deductible.

Best 529 Plans in New Jersey. New Jersey offers tax benefits and deductions when savings are put into your childs 529 savings plan. Deduction for contributions into a Franklin Templeton 529 College Savings Plan of up to 10000 per taxpayer per year with gross income of 200000 or less beginning with contributions made in tax year 2022.

Section 529 - Qualified Tuition Plans. Pennsylvania with a 30000 maximum.

Preventing State Tax Subsidies For Private K 12 Education In The Wake Of The New Federal 529 Law Itep

How Do I Choose A 529 Morningstar 529 College Savings Plan Saving For College Bond Funds

South Dakota 529 Plans Learn The Basics Get 30 Free For College

The Internet Guide To Funding College And Section 529 College Savings Plans Savingforcollege Com

Nextgen 529 Client Direct Series Maine 529 College Savings Plan Ratings Tax Benefits Fees And Performance

529 Accounts In The States The Heritage Foundation

Nextgen 529 Client Direct Series Maine 529 College Savings Plan Ratings Tax Benefits Fees And Performance

Preventing State Tax Subsidies For Private K 12 Education In The Wake Of The New Federal 529 Law Itep

Tax Benefits Bright Directions

![]()

Where To Start When Choosing A 529 Plan Saving For College

/students-studying-at-the-brody-learning-commons-542676220-139d527ccb9d46ae8de34ecc77b78c96.jpg)

8 Factors To Consider When Comparing 529 Plans

Preventing State Tax Subsidies For Private K 12 Education In The Wake Of The New Federal 529 Law Itep

Tax Benefits Bright Directions

Parents Can Use A 529 Plan To Pay For K 12 But Most Won T

Grandparents Faqs On 529s College Savings For Grandchildren

Michigan Mi 529 Plans Fees Investment Options Features Smartasset Com

Dc College Savings Plan District Of Columbia 529 College Savings Plan Ratings Tax Benefits Fees And Performance